By Rohan Shah and Siddharth Dave –

The COVID-19 pandemic has been a crisis like no other. Not only has it taken lives and disrupted livelihood in every corner of the globe, it has the potential to knock economies into simultaneous recessions not seen since the 1870s (Source: International Debt Statistics 2021, World Bank)

What Have Countries’ Governments Been Doing To Tackle This Pandemic?

Every affected country (and that includes the most developed nations as well as the emerging and developing countries) is literally on war-footing. Financing the increased healthcare expenditure, procurement and distribution of vaccines as well as providing economic stimulus to those who have been worst affected by this pandemic, is not an easy job. Along with meticulous planning and execution, the most important requirement is adequate funds to bankroll this.

How would the government raise such a massive amount of funds? Does the government have a secret stash of money lying in a Gringotts bank vault? No. Typically, governments finance public spending by raising taxes, cutting existing outlays or increasing the sovereign debt.

Obviously, increasing the tax burden on the common public in such testing times is not a popular move. And usually, there aren’t many planned outlays that can be cut, otherwise, there’d be a tremendous risk of stagnation, leading to long-drawn recession. Eventually, borrowing funds seems to be the most viable option which seems to be left. However, several considerations relating to lender availability, overall economic impact and financial health parameters need to be kept in mind.

What Is Sovereign Debt?

In simple terms, it is basically what a country’s government owes. Each day that the government spends more than it makes, it adds to the debt. Sovereign debt is usually for financing the budget deficit which is the difference between the flow of government spending and the flow of government revenues (mainly taxes).

From Where Does The Government Get The Funds?

In theory, the government has various options to borrow funds. Internal sources of borrowing include raising money from the public as well as commercial lenders, and are typically raised in local currency. External borrowing sources include various market-oriented methods such as issuing bonds and availing long-term loans. Countries having lower market access tend to reach out to global financial institutions such as the IMF and the World Bank.

Practically however, the majority of the government’s borrowing comes from two sources – (i) the public, and (ii) quantitative easing (QE) measures. While you may be familiar with the various QE measures, it may be surprising to imagine how the government is able to borrow from its own citizens. Households not experiencing income losses during the lockdown phase had far fewer opportunities to spend money as whole swaths of the economy shut down, so their savings increased dramatically. Further, in such uncertain times, people also prefer risk-free investments, and what better than those investments which are guaranteed by the government itself. The sovereign gold bond series introduced by the government in India is a classic example of such borrowings, wherein the tenure is medium-term (5 to 8 years) and the fixed return guaranteed is quite low (2.5% interest per annum), at the same time attractive to the public since the variable returns are linked to market forces.

Where Do We Stand Today?

To tackle the health crisis and its massive impact on the economies, governments and central banks have deployed a wide range of measures, which also include large discretionary fiscal stimulus packages. As a result, the sovereign debt levels have surged across the globe.

i. Germany, who has long maintained a policy of constantly maintaining a balanced budget and never taking on debt, has been forced to suspend the debt rules and spend considerable funds to protect the health of citizens and stabilise the economy.

ii. South Africa projected its budget deficit would widen to 14.6% of GDP in the current fiscal year, the highest since the end of apartheid. They have also announced a coronavirus relief package equivalent to 10% of South Africa’s GDP.

iii. Japan’s gross government debt ratio of around 230% of GDP at end-2019 is the highest amongst the world. It is estimated that the wider projected fiscal deficit and decline in GDP this year could raise the debt ratio to well above 240% of GDP in 2020 and 2021, before it returns to a gradual downward trajectory.

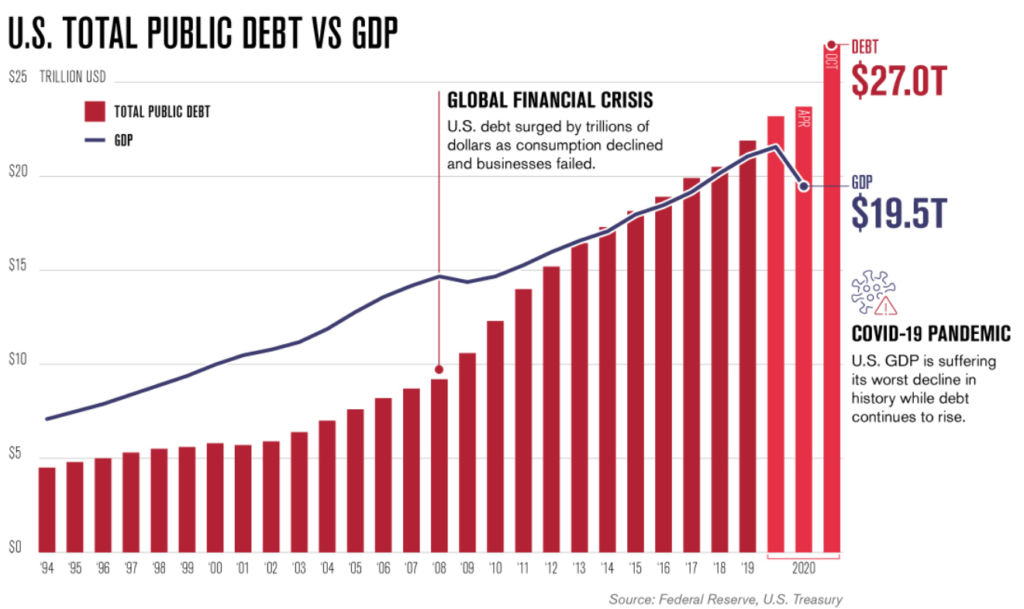

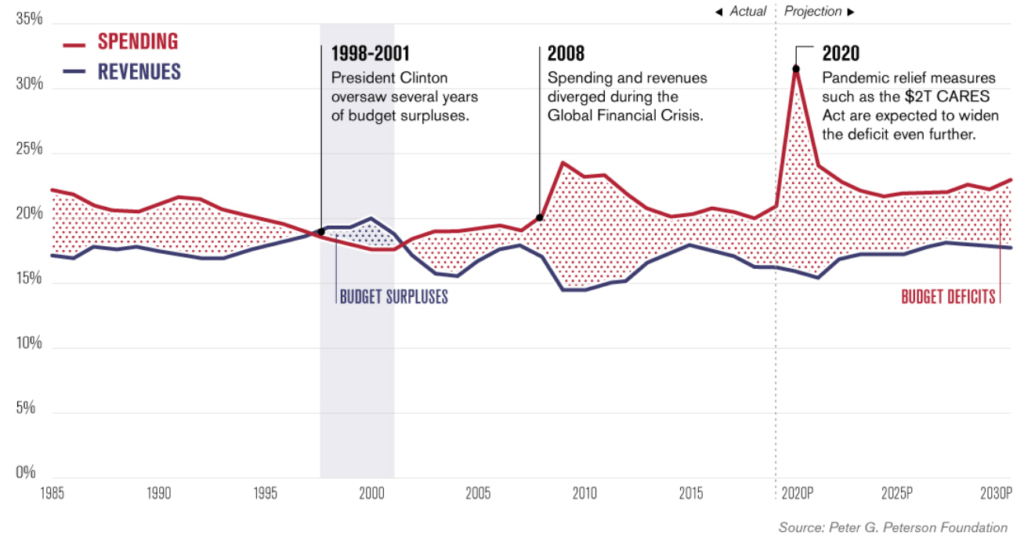

iv. Since the Global Financial Crisis, USA’s national debt has often grown at a faster rate than the GDP. By April 2020, the national debt had surpassed the GDP by almost 18%, pegging the total debt at approx. $27 trillion. The existing budget deficit is around 25-30%, which is expected to further widen due to pandemic relief measures such as the $2T CARES Act. In fact, with the Biden administration in, and with Speaker Pelosi’s new stimulus package, the USA government is likely to take another tranche of borrowings to keep itself running.

v. The situation for the under-developed and emerging countries is worse. They are facing risks of a sovereign debt default, which makes it harder to borrow or attract investment in future, opens up legal liabilities, and can have destabilising knock-on effects. Credit ratings firm Fitch says Argentina, Ecuador, Lebanon, and Suriname have defaulted already, in what it predicts will be a record year for defaults, while Zambia has started “a default-like process”. The World Bank and the IMF list Mozambique as one of eight countries in “debt distress”, while 28 others were considered at “high risk” as of June 2020.

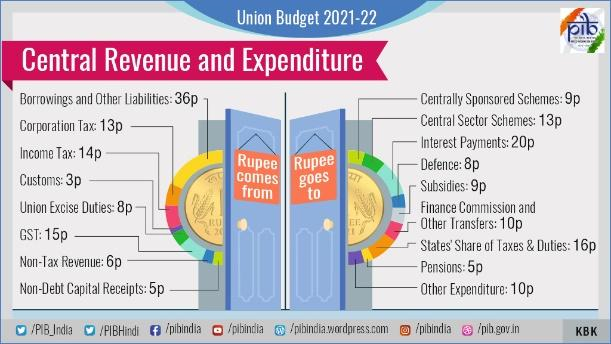

vi. India’s public debt ratio, which remarkably remained stable at around 70 percent of the GDP since 1991, is projected to jump by 17 percentage points to nearly 90 per cent because of increase in public spending due to COVID-19, the IMF said and the simultaneous fall in tax revenues and economic activity. The fiscal deficit for FY 2020-21 was earlier budgeted at 3.5% of GDP and now has been revised to 9.5% of GDP.

The coronavirus pandemic is likely to cause a long-lasting “zombification” of the global economy, i.e., slow growth, low inflation and high debt, which will become common across advanced economies following the pandemic.

Is Debt At Such High Levels Really A Problem?

While the numbers may seem exorbitant, the conclusion of various economists and finance experts around the globe is that the current debt levels may not be a major concern. The brief reasons are summarised below:

Absolute Debt Level is a poor indicator of ‘troubled economies’

i. The debt needs to be measured relative to the size of the economy and also needs to factor in related economic aspects such as inflation, population growth and productivity growth.

ii. A popular measure is to use the ratio of debt to GDP as the standard measure for examining trends over time. A rising ratio means that debt is growing faster than the economy, while a shrinking ratio means the opposite.

iii. History has time and again shown that economic growth can lower the debt ratio despite rising debt. This reinforces the point that a growing economy can be more important than a growing debt, given that economic sustainability can service additional debt taken to fund the rising economy. In corporate and personal finance, this method would be called capital gearing, however countries’ indefinite existence allows gearing to take place over decades, perhaps even centuries.

Empirically, higher debt-to-GDP ratios are growth stimulating

i. Earlier theories suggested that a debt-to-GDP ratio of 60% for developed countries and 40% for emerging and developing economies would be prudential. But, crossing these thresholds may not pose any real threats to debt sustainability.

ii. As long as there is spare capacity in the economy or unemployment, higher fiscal deficit adds to purchasing power and may not be a factor for higher inflation, nor for large current account deficits.

iii. While the debt ratio can’t grow forever without harming the nation, it can and should grow in an economic downturn to minimize human suffering and the threat to longer-term growth.

iv. In fact, most developed economies are testament to this. As mentioned above, Japan has debt ratios as high as 230% of GDP, while that of EU countries and USA also typically found in excess of 100% of the GDP.

Higher debt-to-GDP ratio now is beneficial vis-a-vis lower GDP later

If the government opted for lower spending to combat the pandemic to keep the debt-to-GDP ratio in check, it would leave the economy weaker for an extended period of time. Loss of employment and shrinking market demand can lower productivity for years. All this may lead to slower growth, thus reducing the GDP (denominator) in the coming years, which will eventually lead to increased debt ratio. Economists believe that enacting additional policies to reduce the pandemic’s extent and costs would alleviate economic hardship, speed the recovery, possibly improve the economy’s long-run productivity, and thereby lessen the overall rise in the debt ratio.

COVID-19 alleviation costs are temporary in nature

A virus life-cycle is usually short and would last for maybe a couple of years. Accordingly, the costs to combat the pandemic may be treated as one-time exceptional costs. Permanent costs (such as permanent tax cuts) will add growing amounts to the debt every year, forever. So even though the debt ratio will grow in the short run, the long-term fiscal gap may be only somewhat larger than before COVID-19 hit.

Some Key Considerations To Be Kept In Mind

Rising interest costs

Even though the sovereign borrowings are at a low interest rate, governments end up spending a huge sum of money to regularly finance the interest cost every month. It needs adequate cash-flow planning to avoid debt defaults. Also, they need to be mindful of long-term debt, because the interest burden will keep on increasing with the increase in interest rates once the economy improves.

Debt transparency

Governments who borrow to manage their economies and fund investment must have strong institutions, processes and controls to manage the debts they incur. Poorly managed borrowing can quickly destabilise an economy.

Low-income countries cannot easily raise funds from the internal market, and hence increasingly tap non-traditional sources of credit, such as private lenders and international bond markets. This may open smaller countries to the greater geopolitical risk, in case of extensive defaults.

Borrowings in foreign currency may be riskier

Any governments’ borrowing in local currency is generally considered less risky because as a last resort the government can print additional currency notes to meet any debt obligations. While this could lead to a decline in the value of the currency, the government would still be able to pay up on time and save itself from the embarrassment and catastrophic implications of default. However, in case of foreign currency denominated borrowing, a government does not have the ability to print foreign currency and therefore the risk of default is much higher. This has been seen several times in the past with several countries including Greece, Turkey, Ghana and Russia having defaulted in the past.

Adverse impacts of quantitative easing (QE) measures

When a central bank takes permanent ownership of its own government’s debt, that debt ceases to exist for all practical purposes. Thus, by buying up its own bonds, the country would be financing its expenses through printing currency rather than real money flow. As seen historically, the central banks face difficulties in unwinding its balance sheet, and hence much of this debt will remain on the central bank’s books in perpetuity.

Increase in the supply of money in the market, if unchecked, may also lead to runaway inflation. Further, it is seen that QE often leads to increased stock valuations. Because this program pushes down bond yields, some experts have argued that it facilitates more risk-taking among investors, pushing them into higher-returning investments, like stocks and real estate which may lead to certain asset bubbles being created.

Conclusion

Concern about debt should not short-change the nation’s efforts to fight the pandemic, care for those harmed by it and by the sudden and deep recession, and restore the economy to health when the situation allows. Starving the economy in the name of fighting debt would be short-sighted and self-defeating. At some point, action will have to be taken to rein in the deficit, but we may be a long way from that point.

This post was written in collaboration with Asif Yahiya Sukri LLP. Asif Yahiya Sukri LLP provides unparalleled personalized financial services to a broad range of clients across different geographical locations. With a presence in the USA, India and the MENA region, they ensure that all of your financial decisions are made carefully and with your best interests in mind. They are innovators who understand what goes into building companies. You can also reach out to them at [email protected]

(The article was first published by The Financial Pandora, which has agreed to share its content with The Kashmir Monitor)